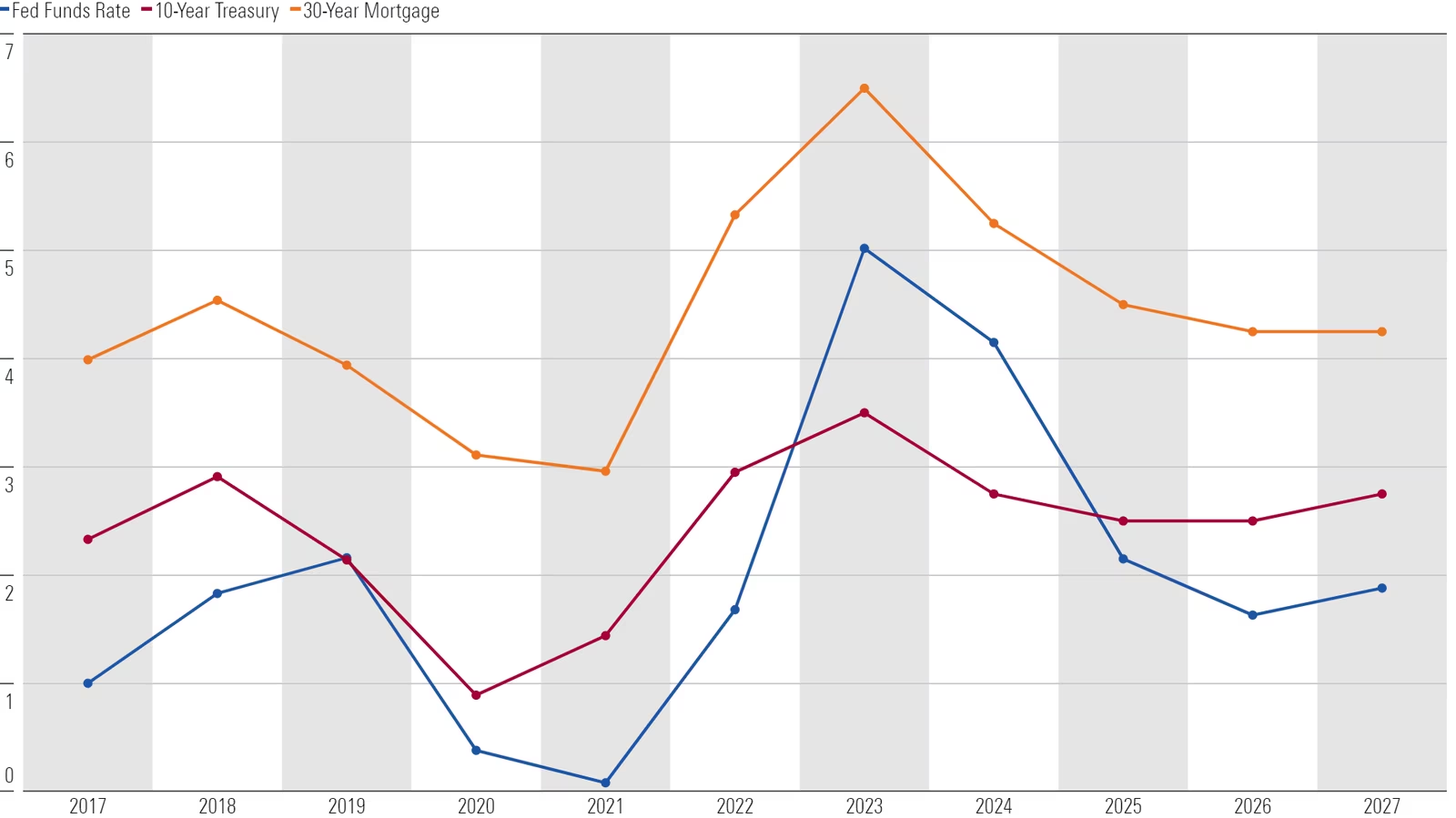

4% Interest Rates by 2025?

I wanted to share some key insights from a recent Morningstar article discussing the Federal Reserve's stance on interest rates.

The Federal Reserve has been increasing interest rates to combat high inflation. However, they are expected to start cutting rates from the beginning of 2024 as inflation falls back to its 2% target and the need to support economic growth becomes a priority.

Interest-rate forecast. Morningstar projects a year-end 2023 fed-funds rate of 5.25%, falling below 2.00% by mid-2025. That will help drive the 10-year Treasury yield down to 2.5% in 2025 from an average of 3.5% in 2023. They also expect the 30-year mortgage rate to fall to 4.5% in 2025 from an average of 6.5% in 2023. 2025 should be a good time to refinance for those who took out a home mortgage at elevated rates.

Inflation forecast. Morningstar projects price pressures to swing from inflationary to deflationary in 2023 and following years, owing greatly to the unwinding of price spikes caused by supply constraints in durables, energy, and other areas. This will make the Fed’s job of curtailing inflation much easier. In fact, Morningstar thinks the Fed will overshoot its goal, with inflation averaging 1.8% over 2024-27.

For more detailed insights, you can read the full article here.